The Math Challenge with Convertible Notes & SAFE’s

As an investor, we have utilized Notes many times as a way to guarantee maintaining or increasing our shareholding in a startup ahead of the next financing round. We do this to generally achieve one of the following:

(i) to act quickly ahead of Investors fighting for equity so we retain or increase our shareholding;

(ii) in ‘bridge’ situations where a startup shows promise but does not have the metrics/product fit yet and needs a bit more time to attract the next round Investor.

From a Founder perspective, Notes can help raise financing quickly while keeping the Noteholders removed from any effective control. Generally, they are used:

(i) strategically, to increase valuation of the company by it utilizing the funds effectively to gain more traction and revenues; and/or

(ii) to bridge the company until the next financing round without necessarily setting a valuation.

What is not obvious is the potentially large dilutionary effect Notes can have on the Founders and early shareholders.

We always recommend to our portfolio companies to keep their Notes to less than 20% of the next financing, so as (i) not to artificially raise the effective valuation in the eyes of the Investor, (ii) not to cause unintended dilution for themselves and their existing shareholders, (iii) allow a meaningful participation by Investors in the financing, and (iv) to end up with sufficient cash in the Company post the financing so as to achieve their aims. Lets illustrate:

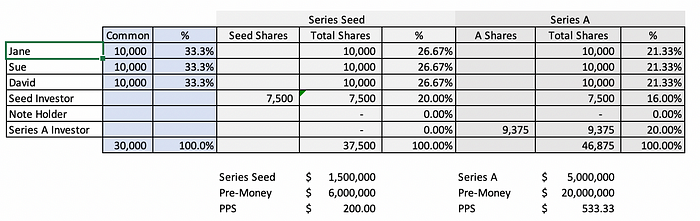

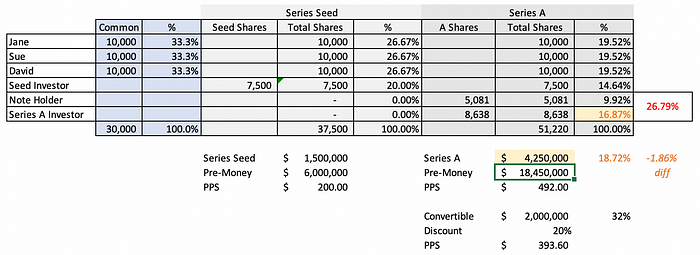

Standard Financing — No Note: In the above example, a simple Series A financing is shown that follows a Seed financing. The Series A Investor receives 20% of the shares for an investment of $5m (i.e. a $20m pre-money valuation). The three Founders keep 21.33% each in the company.

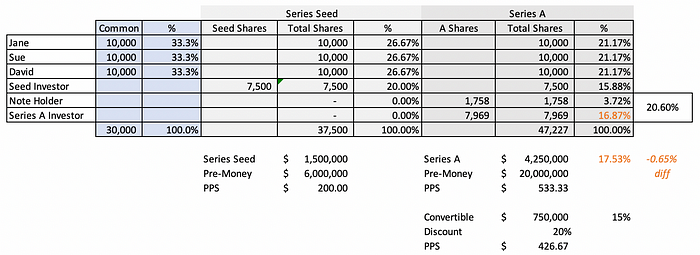

Notes — First Case: Next, we show an example of the same $5m Series A financing, occurring in two steps. First, usually 6–12 months before the financing, an Investor provides a Note to the company of $750,000. The valuation we are using is a 20% discount to the next financing round. (To simplify further we have not added a ‘cap’ i.e. a maximum pre-money valuation).

As you can see, the effective dilution is only 0.6% (i.e. 20.6% vs. 20%). So a good deal by any measure. In this case, the Note is limited to 15% of the Series A financing, which enables the incoming Investor to end up with a decent shareholding in the company, without feeling that they are paying a substantial premium or being diluted by the Note. Chances are that at the end of the financing, Founders have sufficient cash in the business to meet the goals set out when raising the funds i.e. > $4.5m (an amount that remains from the funds advanced under the Note and the new $4.25m that came in from the Investor).

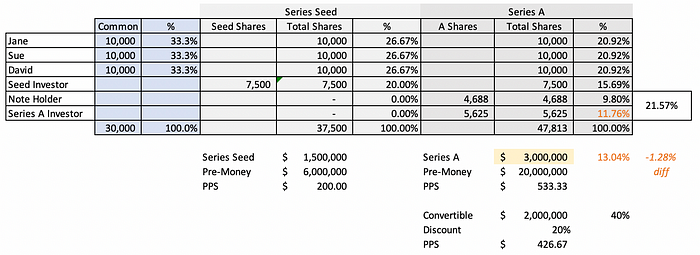

Notes — Second Case : Now, lets look at what happens when Notes are over 20% of the financing round…

In this example, the Founder has raised $2m to extend their runway substantially. They then raise $3m to achieve their original goal of a $5m financing. Now, however, the dilution is 1.57% greater. In this case, the Note is 40% of the total financing. However, there are a greater set of challenges which make the funding more onerous to the incoming Investor :

(i) $3m on a $20m pre-money would have yielded the Investor 13%. $3m of the $5m intended financing would have yielded 12% which is ok so long as the Investor knows there is substantially close to $5m in the Company when the financing is complete. But in the above example, due to the discount effect of the Note, the Investor receives 11.76%. So the Investor has taken anywhere between a 2% — 9% haircut (or by the same argument they are overpaying by 2%-9%). The main risks here, besides the valuation, are that

(i) the Series A Investor does not want a low ownership level, and this probably triggers the Third Case below;

(ii) The company probably only has around $3.5-$3.75m cash at closing, so it’s starting its next stage on the back foot; and

(iii) Less problematic, but worth noting, are the previous shareholders that are now diluting by 21.57% instead of 20% i.e. an 8% increase in dilution.

Notes — Third Case : When things get bad… An even worse situation occurs, if the company actually needs close to the $5m on closing to execute its plans. In this case the following may occur:

We assume, as in the previous case that by the time closing happens, there is possibly as much as $750k still left in the business from the Note.

(i) As in the first Note example, $4.25m yielded the Investor 16.87%. That was at a $20m pre-money financing. However, now the Investor receives far less. So what does the Investor do? They come back demanding the same original percentage they expected. To get that same percentage, the only way possible is to reduce the valuation, which, in turn reduces the Note conversion valuation as well. So where the shareholders had a 20.6% dilution in a simple Note of reasonable size, they now have a 26.8% dilution — i.e. an increase in dilution of 30%!

(ii) As a consequence, the valuation is now set lower and this affects the next financing round valuation. Additionally, where the Company would have usually parted with ~20% for its financing, its now communicated that it’s willing to part with ~27% for a financing. This affects future financings.

(iii) Even worse is the dilutionary effect on shareholders due to the inevitable ‘re-upping’ of the ESOP (and founders) down the line. That ends up diluting, in effect, the earlier shareholders as they are squeezed by the ESOP and the new shareholders. Additionally, the Seed Investors have a significantly lower ‘mark up’ as the blended price per share of the round is lower too.

In summary, our advice to Founders is not to raise more than 15%-20% of any future financing using Notes. It ends up hurting everyone.

Related Resources

How should I reach out to a VC for the first time?

Why is it so hard to get VCs to invest in my Generative AI Startup?