The SaaS Reckoning: Surviving the AI Token Revolution

The software industry has reached its most significant “Fork in the Road” since the emergence of the cloud. As of early 2026, the market has transitioned from speculative AI hype to a structural reckoning: public SaaS valuations have plunged 70% since late 2021, while the tech-heavy Nasdaq has surged 80% in the same period. This divergence signals a fundamental shift in how the world values software.

The “Rule of 40” is no longer enough to support software valuations. To survive, SaaS incumbents must stop “organizing work” and start “completing it” through autonomous agents that own the context of the user.

Decoding the New Software Lexicon

The survival of an incumbent depends on its evolution across three critical dimensions:

Systems of Record (SOR) vs. Systems of Context: A System of Record (e.g., Salesforce, Workday) is the “DNA” of an enterprise—the final authority on who a customer is or what an employee is paid. However, AI value is moving toward Systems of Context—platforms that understand not just what the data is, but the “situational awareness” around it: business goals, team priorities, and historical nuances that explain why a decision was made (e.g. monday.com).

Labor-Rent Wrappers: This is the “Software is Dead” camp’s label for applications that exist solely to move data between teams or “rent” out human-click efficiency for $100-$300 per seat. These “thin SQL wrappers” are highly vulnerable to AI agents that can perform the same clicks for pennies.

Vibe Coding: A new (primarily web) development paradigm where non-technical users “guiding an AI assistant” can generate functional software clones of billion-dollar products like DocuSign or Typeform in a few hours.

Non-discretionary providers remain in a much better situation e.g. Key Cybersecurity (Palo Alto), Data Infrastructure (Snowflake), Connectivity (Cloudflare). Large enterprises are not about to shed these or risk a new “AI player”.

Market Indicators: The Evidence of Displacement

Current indicators point to an era where incumbency is a double-edged sword.

The “Play Dirty” Era (Present): Large incumbents have begun using defensive game theory to protect their data moats. Companies like Salesforce, Datadog, and Epic are restricting API access (or charging huge sums), to AI-native startups to prevent them from “siphoning” the context needed to build competing autonomous agents.

Revenue Asymmetry (Present): AI-native startups are currently growing at 100%+ while traditional SaaS top growth performers have stalled at ~25%. This gap is driven by quick adoption by customers and AI experimental budgets. It’s worth mentioning that talent is going into new startups and “greenfield” AI architectures rather than retrofitting legacy code.

R&D Allocation (Future): High-growth companies are now spending over 50% of their R&D budget purely on AI development, signaling a complete pivot away from traditional software maintenance toward the “Token Revolution”.

The Future: A World of Token Factories

The long-term goal for AI companies (OpenAI, Gemini, Anthropic) is to maximize usage and thereby effectively disintermediate the SaaS GUI entirely. Their plan for doing so will probably look something like this:

Short Term (2025-2027): The “AI Front Door” LLMs move from chatbots to Operational Coworkers like Claude Cowork. Instead of users logging into 20 apps, they interact with one “front door” that has permission to read files, browser sessions, and calendars. In-house “vibe-coded” tools begin replacing long-tail SaaS utilities for things like basic CRM and form building. Distribution and corporate venture capital plays a big part.

Medium Term (2027-2030): The Contextual War. The battle moves to Memory Tokens. These are proprietary tokens that capture your specific business logic, writing style, and decision preferences. The “SaaS Bond” narrative takes over. SaaS companies will show rising profits but flat stock prices as growth migrates to the model providers who own the “Context Ladder”. So this is the challenge to the incumbents – how to retain most of the context. This could, for example, mean incorporating open source LLM’s internally to their solutions. Customers also have a say in this, as it will take time to convince them that their business IP remains theirs.

Long Term (2030+): Agentic Autonomy. The shift to Autonomous Token Factories where machines negotiate with other machines via intent-based protocols. The classic idea of SaaS—users communicating via an interface—becomes obsolete. Every business becomes a supplier to LLM “factories” (or retains LLM capability internally that then interfaces with the outside world), that transform data tokens into high-level intelligence outcomes.

“The AI-native bot is fast, but our Orchestrator is Safe, Compliant, and already knows your CEO’s priorities”

In this world, the AI Orchestration Layer becomes critical to incumbents retaining market share and moving into an AI credible offering. The AI Orchestration Layer is not only a technical component, but will serve as the primary defensive “moat” for SaaS incumbents. While AI-native startups leverage speed and “blank sheet” architectures, incumbents can use orchestration to turn their greatest vulnerability—legacy complexity—into their strongest defense: Enterprise-Grade Governance.

Orchestration can act as a “traffic controller”, through 3 pillars : Security, Context and Workflow Governance. Security can control “Bot Chaos” in an organization and context i.e. the reason why a task is executed can be controlled by incumbents through internal agents that are not exposed to outside LLM’s/agents. This is, at best, a tricky act to juggle.

Enterprises are not going to throw out decades of investments in their technology stack overnight in favor of AI. The final outcome will take many years to materialize. Take Oracle as an example, everyone wrote it off 15 years ago when the cloud happened. Incumbents are not going to just fall over and die without a fight.

In all this, it may be wise to ponder the thought of “who bears the responsibility, accountability, and liability”. Today humans do. It’s not clear when regulators will decide that AI Agents and LLMs can carry these heavy burdens, so until then, humans will be in the loop…

Related Resources

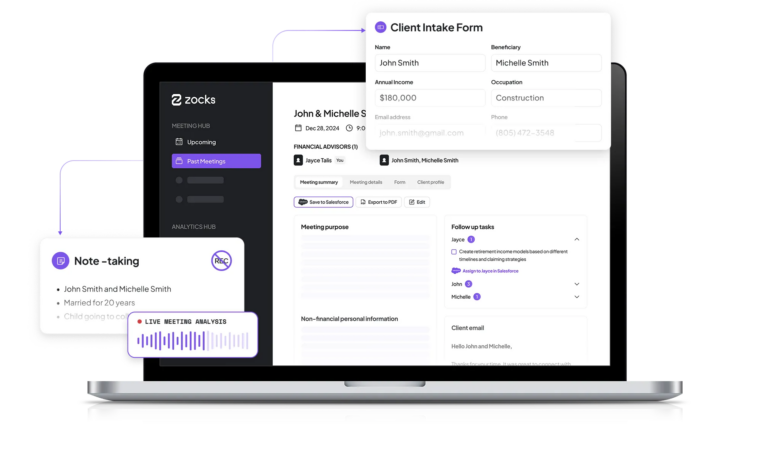

Zocks, raises $45m Series B to Expand its Agentic AI for Financial Advisors

Sensi.ai’s $100M Journey: Vertical AI Shaping the Future of Care Intelligence