Chasing ARR in a New AI World: Risks of Moats and GTM

Getting to a couple of million of dollars in ARR a few years ago used to be a major milestone for B2B companies. It typically signaled strong product-market fit, commercial validation, and early operational maturity.

Although that’s still factually true today, the AI revolution is changing all these comparables and accordingly so our interpretation and metrics need to change.

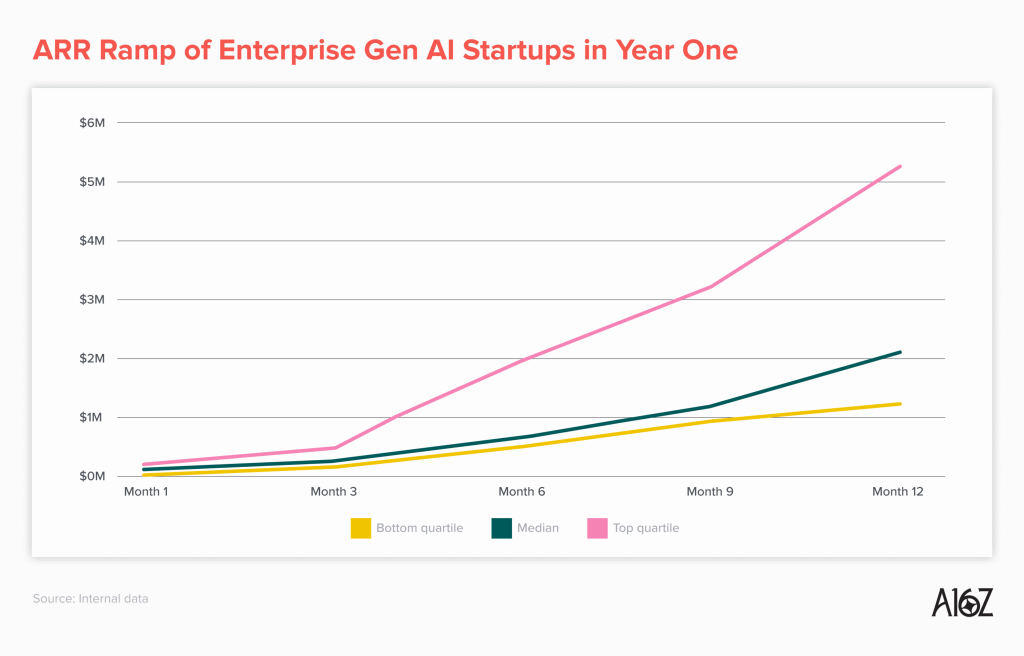

📈 Startups Are Growing Faster Than Ever

Enterprise Gen AI startups are growing at an unprecedented speed. Those in the top quartile are reaching $1m in roughly 3 to 6 months from launch day (see chart), and many get to $3m-$5m within the first year.

What once signaled a clear breakthrough for a company in its category has now become more common. As a result, early ARR should no longer be viewed as a standalone indicator of product-market fit or long-term viability.

🤔 Quality of Revenue – Is Your ARR Truly Annual and Recurring?

As recently as 2020, a company with ~$3M in ARR often had predictable, reliable revenue. Contracts were typically annual, retention was high, expansion followed a clear pattern, and net dollar retention (NDR) and lifetime value (LTV) were reasonably forecastable.

Today, many startups quickly reach a few million in ARR, but upon closer inspection, it’s often trial-driven, with monthly payments, flexible terms, opt-out clauses, and minimal integration, leading to low switching costs.

This makes it difficult to accurately assess the quality of ARR recorded.

💸 Pricing Is Evolving

Pricing models have shifted from pure seat-based to hybrid models combining seats and usage, such as:

– Credits (e.g. Monday.com)

– Tasks/workflows (e.g. Zapier)

– Resolution units (e.g. Zendesk AI resolution add-ons)

– Tokens, API calls, or outcomes in AI infrastructure companies (e.g. OpenAI)

This hybrid shift means product usage now directly correlates with actual revenue, and pricing will likely continue to evolve over the next 1-2 year period.

👑 Meet the Kings: Product Moat and GTM Strategy

Barriers to product development have dropped significantly. What once took months can now be built to MVP level in weeks, or even days, using LLMs, APIs, and open-source models.

While this accelerates time-to-market and customer acquisition, it also makes it harder to sustain a product moat.

Acquiring customers doesn’t guarantee category leadership without a defensible product or go-to-market (GTM) edge. To lead a category, startups need clear product-market fit with tangible ROI for customers.

As technological moats become harder to maintain and timelines shorten, GTM strategy becomes a key differentiator.

Building a strong brand, cracking customer acquisition, embedding deeply into customer workflows, and building communities will set winners apart from the rest.

In the AI era, speed and GTM leverage often outweigh a marginal product advantage.

🎒 Key takeaways along your growth journey

Reaching $2M–$5M in ARR quickly is no longer a sufficient indicator of product-market fit. You must understand how that revenue was generated: does it reflect real customer love and usage, or just experimentation? Is it durable against rapid commoditization and competition?

If you’re scaling your startup, focus on:

✅ Building product moats that drive stickiness: proprietary data, deep integrations, embedded workflows.

✅ Being obsessive about usage: make it a key KPI, it’s your best proxy for retention and expansion.

✅ Modeling revenue durability: segment ARR into committed, likely, and risky; plan around realistic retention and usage.

✅ Investing early in scalable GTM: lay the foundations for sustainable revenue, not just short-term spikes.

✅ Build the foundations for lasting revenue, not just the next 3-6 months.

Related Resources

Guidde: The AI-native horizontal PLG startup that could

The SaaS Reckoning: Surviving the AI Token Revolution