Monday.com’s Challenges at the Seed Stage

Hosted by Lior Krengel and Eran Zinman, ‘Startup for Startup’ is a podcast where monday.com openly shares its knowledge, experience and actionable insights among startups. The podcast was originally recorded in Hebrew in May 2019, and is available here. What follows is the translated and transcribed podcast.

This week we’re going back in time to a period of uncertainty for monday.com — January 2014. We still had not crack the product-market fit and had only a few more months worth of cash left in the bank.

Many start-ups find themselves in similar situations along the way — conviction in the product is high, early feedback is promising, but the road ahead isn’t clear. In these tough moments, investors’ moral support is crucial for moving forward. What does this support look like? How do you build it? What influences the investors’ decision at these early stages?

Joining us to answer these questions is Avi Eyal, a co-founder and Managing Partner at Entrée Capital. Avi invested in monday.com at the Seed round in 2013. In this episode, he shares the thought processes of an investor that needs to make pivotal decisions quickly, all while relying on little data and taking big leaps of faith.

On the podcast are:

Lior Krengel — EcoSystem Relations and “Startup for Startups” PodCast at monday.com

Eran Zinman — co-founder and CTO at monday.com

Avi Eyal — co-founder and Managing Partner at Entrée Capital, and Board Member at monday.com since 2014.

We’ve taken excerpts from the podcast and shared them below.

Lior: Hi everyone, you are listening to Startup for Startups, the podcast where we share experience, knowledge, and insights we have here in monday.com and other companies as well. It is intended for everyone interested in startup, no matter what their title is.

Lior: So, today’s episode is about going back in time. We’ve held almost 200 meetings with various entrepreneurs here in Israel, and one of the most often discussed subjects at the meetings is the subject of fundraising. Alongside an open discussion and a very honest attempt to help, the question always arises “well, you didn’t have a hard time like we have, right? And your way was easy, and this is not fair to compare so does not count”. Today’s episode speaks to the harder times we had, around product market fit, when we did not know what our direction was, and things were less obvious. Even today not everything is simple and clear, right, Eran?

Eran: Not at all.

Lior: We will go back in time to the period between the Seed and Series A funding rounds, and for this matter, Avi Eyal will join us. There were harder times…

Avi: Hi

Lior: Avi is the co-founding partner at Entrée Capital, and an investor in early stage companies, and here, at monday.com he invested in the Seed financing and every financing round thereafter, right Avi? He joined us early, in 2013, and we are already in 2019, so this has been a long road…

Avi: Yes, really, at the beginning…

Lior: Avi, we invited you to discuss the challenges we had along the way, the decision you made to invest at an early stage, at a critical time, and later put money into CLA’s (convertible notes / SAFE), as you will hear soon. What is the rationale? What is the decision making process? How do you look at risk? Eran, what happened in January 2014, where was the company at the time?

Eran: So, in fact Avi invested $1.4 million in the company together with Genesis, another VC, in the seed round, which was in February 2013. At the end of 2012, beginning of 2013, we had a product, we had one big client named Wix, and several small clients. We were, at the time in the company, at the stage of trying to get to “product market fit”. We didn’t have, in general, “product market fit”. We had a product used by several companies, and based on that, Avi invested, and maybe he will tell us about that, but we thought we will go out to the market and replicate the product’s success with other companies, but it didn’t work. The product looked very different to what it looks like today. The problem it addressed was very similar to what we have today, that is, we always wanted to improve how teams work, and cause them to fulfill their potential as a team. But the way we handled the problem then was only by communications. The product was only inter-team communication, and no matter how hard we tried to implement it in other teams and companies, the clients always thought of it as “nice to have” — we came out of meetings, with customers saying “it’s cool”. They didn’t really understand the value, they didn’t really understand what this gives them, and we couldn’t on-board new clients successfully. It was a difficult time back then, as on one hand, Roy and I are programmers, so we always wanted to add new features to the product.

We always thought “just add one feature, and we’ve nailed it” — everyone will want to use this. We underwent a very difficult period when we couldn’t sell, and the company felt stuck. At the time, the money began to run out faster and faster. We also hired employees to move faster, and we were really at confusing point in time.

Lior: And then we get to January 2014, a board meeting, this is the state of mind everyone comes to the meeting with, Avi, where were you at the time, regarding the company?

Avi: So, we invested in the company. The investment in the company was based on several things. One thing I really liked was the entrepreneurs. Another is that the last company I co-founded was in the business of risk management, which was very successful, but the challenge we had was that in 2004, the architecture of the product didn’t allow us to perform the permutations we wanted to do. This was “dashboarding” — you could say it was a monday.com look alike — but in the form focused on one solution set. The company was a great success, because we could take different types of data and enter it into the system without doing customizations. Everything was drag & drop, and what I saw at DaPulse (now monday.com) at the time was a similar use case, far more elegant, and they could potentially solve the problem we couldn’t solve nine years earlier.

Eran: Let me challenge you for a minute, Avi. When you invested the seed round in the company, the “boards” were not part of the product.

Avi: True. dapulse (now monday.com) was leading with pulses and communications as core features, but the idea was there, and you guys were testing it. So the challenge was how to make it to something everyone understands…

Eran: True.

Avi: We needed to turn it into something that customers better understand. The challenge in the company was that we fought against “Yammer” and such, and were solving the “boards” issue from an inverse perspective. This board meeting was very significant, as the dynamic was difficult. There were investors who were not interested anymore and wanted to move to the next investment.

I remember it like yesterday — it was a sunny that day although it was winter at the time, and when I saw the “boards” features, what you put into the presentation, I said to myself, “Wow, that’s it! We found the solution”…

For me it was part of the extrapolation of the history that I had experienced myself, which was really based on what I saw that Roy and Eran worked hard, had not given up, wanted to succeed, and already had several clients, six to be exact…

Lior: One minute, Avi, I love the last part, that’s great, but you’re running ahead and “spoiling the film.” So, one second, you describe, in practice, that in the seed, the entrepreneurs were people you believed in, you identified a direction you knew from the past, so this seemed like an opportunity worth checking out, the product was not really there, right?

Avi: Only the beginning…

Lior: Let’s discuss this for a moment, that other folks walked in to a board meeting that day but didn’t believe that they should continue with supporting the investment. Why?

Avi: After a year in the company, the investors expected that there would be product market fit, more revenues, that the founders knew to whom they intended to sell to, and what they wanted to sell, and so far, and this wasn’t clear.

I recall that the payment page of the site had 6–8 options to pay. Our landing page in hindsight, was quite ridiculous at the time.

Now we can say this but then we couldn’t. These were the challenges, a basis for something good, but no sales for a cheap, easily usable product. And everyone understood that they’re missing something with the product. So product market fit was just not there, and everything else around it contributed to the problem, or to the investors’ doubt. At the end of the day, the company had a problem — it had $400,000 in the bank, it was burning $80,000 USD a month, and it had less than $10,000 in revenue…

Eran: $6,000.

Lior: Sales, do you mean MRR? ARR?

Eran: Monthly Recurring Revenue (MRR).

Avi: Monthly. But most of the revenue came from one client, Wix.

Lior: At this stage there was an expectation that there would be more clients and that things would move faster.

Avi: True. A greater pace, and that things would move faster. When you think of it, if you close the company, you need at least $80,000, so you maybe have three months left. Thus, great doubt! And nothing was about to land, there were no 100 clients going to pay $200 a month never mind $1,000, nothing was certain.

Lior: You paint quite a bleak picture, of a major difficulty, not only of small difficulties. I now understand why you spoke of a good morning with the sun shining. Eran, with what kind of feeling did you enter that board meeting?

Eran: We must separate between the specific board meeting and the period before it. When we had the board meeting, we, the co-founders, already had a solution, some kind of breakthrough we believed, with some kind of hope.

But beforehand, we had the feeling of failure for almost a year. On one hand, we had a few clients including Wix, who used the system and had good usage stats, and on the other hand, we didn’t really know what we were doing, we were unable to land new clients.

I recall a specific situation of me and Roy sitting in Herzliya… We had an advisor named Dudu. We consulted with him, and we said, “let’s create a new landing page every month, to understand what the clients want”, and my stomach turned. We raised $1.4 million USD!!! What did we do with all the money!!!? We were back at square one! The inertia sent us forward, on one hand we had clients like Wix who need features and use the solution, and you have to meet their needs. On the other hand, the company was stuck if you looked at it at a higher level. The combination of those frustrating feelings, we were at the bottom of the bottom, and it was a very harsh period — and we were about to run out of money. On the other hand, we still had a bit of runway, which was the advantage of raising a lot of money at the time, and yet it’s “money time”! The money running out helped us at a certain level, as we needed to change our strategy. I recall the period before the board meeting, when we thought, let’s erase all our thoughts, meet executives of various companies, understand, not how we sell them the product, but what do they need? It’s very different.

Anyone who used software had a “secret Excel file”, which is what we discovered. When we asked how they communicate we understood something very deep from these meetings. We didn’t know that it was Excel specifically, but we knew that people communicating using a grid of colors.

What we understood was this major gap they had, so we added another layer to solution. When we reached that board meeting, in January, it was after two months of using the “boards”, and we had some numbers, and two weeks earlier, we launched the payment option. Something opened up for us, as we said: We believe we should start collecting payment for the product on the internet with no friction. Until then this was more via phone calls and sales. And when we came to a board meeting with Avi and the board members, we presented the “boards” and the payments, and this connects to Avi’s story of what he identified at the time.

Lior: When you raised the funding you did so based on a promise. Usually when raising, it’s based on “what are we going to do with this money”. Before we go back to this board meeting, Avi I’d be happy to hear if you recall what was supposed to happen with those $1.4 million? Were they supposed to continue to develop a product, or focus completely on sales?

Avi: I don’t exactly recall, but in general, we expected to have several or a few hundred customers at the end of the process, and enough MRR so we could continue to the next round (probably $80k+ MRR). But this was not a matter of taking an idea and turning it into a product. Rather it should have been to take the product, replicate the success with Wix and run ahead from there.

Eran: I remember what happened. When Avi invested in the company we were at the same point we were 2 months before the board meeting. We had product, we had a client…

Lior: Yes, it seems that you come with a different perspective, but they could have said to you when you talk about a new product direction and pricing page, that “thank you Mr. Zinman but all of this should have happened a year ago”

Eran: Yes, but we must consider the fact that when the funders invested in the Seed round, they assumed we had a product-market fit, which means, they assumed that if Wix adopted the product as well as a few more clients, then this could be replicated. That’s why Avi had the expectation that when we’ll reach the end of the money will be able to replicate the success. But what actually happened was that we didn’t have product market fit, we could not replicate the success and sell to more clients, and in fact, the basis for his investment, maybe expect the team which he thought had potential and believed in our vision and the problem we were trying to solve, didn’t have any real validation.

Lior: Avi, how much did you communicate with Roy and Eran between board meetings at the time?

Avi: I think that at the time we met each other once or twice a month or so.

Eran: When Avi saw the presentation at that board meeting it was not the first time, we talked about it beforehand, Avi even provided feedback about the design, the platform and the homepage.

Lior: So there’s a feeling of progress between meetings?

Eran: You have to understand, what do you mean by saying “progress”? Let’s say that since we raised the seed, those 2–3 board meeting afterward, I can’t say Avi felt much progress.

Avi: When you are at a seed phase, you invest and then wait to see results. And when there are only 6 months left of money, you start to think about what comes next. So even before January’s board meeting, I remember that there were conversations between the investors as we were worried. It’s not just that we arrived at January’s board meeting with only three months runway left, but even if they had sales, they would have had maybe 6–7 months.

Lior: You mean that the money was not sufficient enough to what was planned in advanced.

Avi: The sales we expected did not happen and the “catch up” did not materialize. When we reached the board — and Eran is right — I had seen and discussed the “boards” a few months earlier — even then I was in love with what I saw; So when I arrived to the board my point of view was that these are charming founders, they are working hard, they came to the board meetings without despair even though you could understand in previous meeting prior to the board meeting that they did feel that way.

I had conviction in what they intended to achieve, so my psychology on the day of that that board meeting was possibly different to that of the other investors.

It could have been that I was in a different place as I was in touch with the startup more regularly than others.

Lior: And now we reached the fateful January 7th, 2014.

Eran: The sunny day….

Lior: How did the meeting go?

Eran: It was a special meeting. On one hand, there was some excitement on our side, as we released the “boards” and truly believed in them. I think we projected it also in our body language and the way we managed that board meeting, I really remember how I felt about it as I spoke with clients and saw that they were enthusiastic about it, and there was great data about this feature, but you have to understand that this was at the very beginning. It might sound unimportant, but we were two programmers in the company, but when we worked on the payment page, even though it might sound esoteric, it was because I had confidence in the “boards” feature. We had the possibility to pay with PayPal, but we invested our time creating a full payment page. We had launched the “boards” and the payment page and got good feedback.

Lior: When we talk to entrepreneurs, they say that feelings must be based on facts. So what facts were your feelings based on, to be able to feel hope?

Eran: Before we launched the “boards”, we talked to clients again to receive validation, and unlike the period we sold them the communications, we saw their enthusiasm. You can feel it in your gut when they are really passionate about it.

Lior: So how many paying customers did you have at the time? And if not customers but leads, please say so.

Eran: At that board meeting, we had 6 paying clients. We had Wix, Conduit. As I worked there before I traveled to 30 miles every month in order to get $200 monthly payment! We had 2 more customers. We talked to clients, both those who were already our clients, but also Roy & I went to meetings with potential clients — leads — and found they were excited as well.

At the time of the board meeting we had 6 clients, “boards”, and a payments page — that was our starting point. I was optimistic, I felt the sun shining on me, maybe that’s why Avi felt it too. I was the first time I felt like we’re on to something.

Lior: What was your goal for that board meeting? Each board meeting involves lots of updates about the past, the products, the future, and then everything comes down to decisions. What decision did you aim to pass at that meeting?

Eran: The last slide of that presentation was that “we did all of that, but there’s only $400K left so what are we doing about it? Raising another round?

Lior: Yes, you guys wanted to raise another round of $5 million, right?

Eran: You have to be optimistic about it…

Lior: So you hoped you will start working on the next round?

Eran: I admit we were not ready for that.

Avi: I remember that at the end of that meeting I was thinking that they uploaded the payment page, and they understood that to sell to clients one by one does not work, and that now there are the “boards”, and the first day I saw it they did more than I expected, so I started contemplating doing a bridge. And as the meeting progressed, so did my intuition…

Lior: Let’s understand. What is a CLA?

Avi: CLA is a convertible loan agreement, today its commonly referred to as an advanced purchase agreement or a SAFE as well. It’s a loan that you extend to the company, and get a discount on the price of the next round of financing the company does. In some cases you may also receive interest on the loan. It’s a pretty efficient mechanism of 3–4 pages that allows the company to receive money pretty fast and to keep moving.

Lior: How does it benefit the investor?

Avi: It gives the investor the option to make an investment quickly when the company needs it, and the investor receives a discount in the next financing round as a result. In my opinion it helps an investor in other ways too. As an example, if the an investor wants to keep the proportion of their shareholding in a business, then if there is money coming in before the round, they know that no matter what happens during the round, they still have a share in the financing and so the investors retain or increase their shareholding in the company. So, if you believe in a startup this CLA mechanism is a good way to retain the bulk of your percentage shareholding. As an aside, I just posted a Medium post on the subject of why not to raise too much money from convertible. But circling back to the board meeting, there was some uncertainty around the table and by the investors, and so to leave the meeting with a feeling of “we came, we presented, now we’re back at our place and working again” does not give the entrepreneurs the required certainty that they won’t be closing the company in a few months.

It was important that we as Entrée Capital be the first to show conviction and support in the company. Then, Eran & Roy could go and meet other people and project the same.

I remember saying that we’ll be ready to invest more money, but that we’d like the other investors to do the same as this is important for alignment.

Lior: Why is that important?

Avi: It shows that everyone believes in the company and is backing them. I think we wanted to raise $1 million dollars, right? So I said that we’ll take the majority of the CLA, giving at least $600K in order to lead the convertible note and to show confidence in the company, and privately I had understood Entrée Capital was in for the full $1m.

Lior: $600K at the time is more than what you invested in the seed round, right? I mean, CLA is an in-between period, and people tend to look at it as a lesser investment than the original investment …

Avi: Correct, so if before we invested 30% of the seed, now it’s 60% of the CLA. But we looked at it, and I really believed in the company, and I saw it as an opportunity to increase my shares in the company as I believed in the company but also, as the founders are the ones pushing forward the company, the investors should be more involved at this phase, and I wanted to step up and also to be responsible for the investment and help Roy & Eran make faster decisions without going back to the investors each time they want to change something. We wanted to see that they can actually do what they plan to do.

Eran: It’s really cool to hear that as we’ve never talked about it. When you say “I wanted to increase my holdings at the company” at that specific low point, it shows a lot of optimism to see that…

Avi: I’m a pretty optimistic person all in all…

Eran: …and today it sounds like a pretty genius but it wasn’t trivial at all.

Avi: I don’t want to take credit here as at the end I wasn’t the one who brought the board together. The founders were the ones who arrived to the meeting prepared, and many times when I’m asked after the meeting that how I could bet “red” or “black” — it might seem like it’s pretty chaotic and others might say “wow where did that come from?” I can’t say 5 years later what the exact thought process I had in mind was, but I do remember that by that stage we were we were also using the beta of the “boards” feature internally — We were one of the first clients, non-paying of course, and still are (laughter)…

Eran: Actually it’s about time…

Avi: …I was absolutely addicted to the product. You have to understand the subject and as an investor you can be passive but, in my opinion, to be a good investor you need a lot of luck, but you can’t be a good investor unless you understand the company you invest it.

Lior: What you are saying is fascinating, as a product like Monday it’s quite easy as it’s for any person working in a team in the whole world. Your ability to be empathetic about it is easy as you can relate to it pretty easily. But is this ability a must condition in your opinion?

Avi: Yes, absolutely. You have to understand how a company works and especially founder psychology. You need to have experience and you need to understand the limits. I can tell you that have a long history where I didn’t understand and as a result, I lost money. The fact that today I’m much more focused is because I keep learning from of my mistakes, not just successes, and that changes the perspective about these things.

Eran: I have a visual memory from that board meeting, it’s very emotional. I remember specifically that there’s one slide… the expenses slide… that we’re looking at. We have a horrible pie chart of how much we spend in each area. I remember that Roy & I were sitting on one side and Johnny from Genesis and others were sitting across the table, and then Avi slams the table and says

“Guys, I’m going to put a convertible loan, let’s do a one million dollar convertible”. And Roy & I weren’t ready for that.

I mean, he did hint about it before the meeting, but he really announced it at that moment, and in hindsight I understand how important that moment was. Listen, it’s that moment in time where you in front of a fork in the road. At the same time, our investors could have said “listen guys, you have the “boards”, your payments, go raise an A round, receive validation from the market”. I can say in hindsight, I mean, it’s hard to foresee the future but if that was the option our company probably wouldn’t exist. Why? Because we were at the same point of the company evolution at the same point we were when we raised the seed. We had a product, a promise, we didn’t prove anything yet so it’s not like there’s something new we could tell. We would never be able to raise a Round A.

Lior: This is actually a disadvantage compared to the seed round, as a in the seed round you didn’t fulfill the promise.

Eran: We just started to get a momentum thanks to the “boards”, the payments… If Roy & I would have started working on a deck for a funding round it not only would have create a major de-focus but other investors would know that we were short on money, that the company isn’t in a good place, and then they would have killed us. What Avi recognized, I think, is the momentum, and that we can take this further, and that was the best option at the time — providing money, confidence, boost, time, and an ability to prove this thing. To close a CLA is nothing, he knew us and didn’t have to do a due diligence, even from legal perspective it was much simpler, as the lawyers were the ones taking care of it and Boom!

The money was in the bank and it gave as a much-needed boost forward. It was amazing for momentum and possibly THE pivotal point for the company.

The fact that the investors and the board were able to see that was not trivial, especially since Avi invested more than he invested in the seed round. It’s like going “all in” and then another ‘all in” an ability to recognize what is going on.

Lior: Let’s understand — this is only the beginning of the momentum, something very basic…

Eran; Yes, but Roy & I always wanted to win, whatever it took. We wanted to win and maybe that was what Avi recognized. But the fact that the board of the company was behind us was what made it all amazing. 2 out of 3 other company boards that would send the company to do market validation. It’s a point in time between success and complete failure.

Avi: You are right, by April you had $600k in the bank.

Avi: It was $600k in the bank out of $670k in total.

Eran: When Johnny (Genesis) saw Avi was excited about it, he also then agreed to transfer funds. I remember we took the whole team to Max Brenner to celebrate that million and it gave a lot of motivation for the team, you could feel that we were on the way to success, even psychological, it was a game changer. And that, in my perspective, is a good board and great investors. People think about that first seed round, but there are plenty of points along the road that are “do or die”, that are critical, and at that specific point you are unaware but in hindsight…

Lior: And yet, you say you were safe but in the numbers game, a year later Avi you provide another CLA.

Eran: Wait, before we move forward let’s finish this story. At the end of the presentation there was a slide of our dashboard with the number 6, which means 6 paying customers. And Avi immediately said “listen, your goal is 25”.

Lior: You had a goal to reach 25 clients in 3 months?

Eran: Avi said that he’ll provide the money.

But he also said we needed to get that number of customers, to show we can do that. Not conditional on his money coming in. In hindsight that also pushed us to a clear path. It was based on our faith of the product, but it’s a major part of the story.

It provides focus of what success looks like. What we had in mind is how to bring the company to Round A, and for that you need a momentum not only of the product but also of growth, of number of paying customers, market validation, not only a validation from our investors, and that brought a major focus for what that convertible was for and how do we take the company forward, and that was an additional bonus.

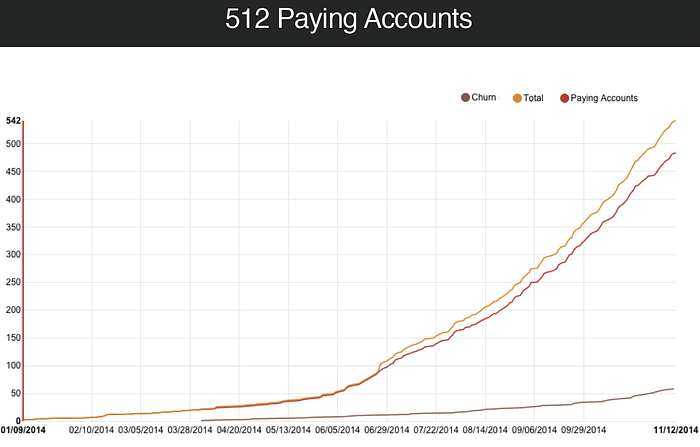

Avi: I think that the first million came with the agreement Roy & Ran focus more on KPIs, so the idea of starting to measure the next target, as the growth should be bigger, we said it should be 2 to the X. We made it exponential. And it worked, as a year after the board meeting, we were with more than 512 clients and it was a major change. But at the time we reached several conclusions: less face to face, less closing deals over the phone, and more online, improving the payment funnel, the landing pages, and showing the fixing on-boarding… everything was part of that “contract”. You can’t expect to move forward without having some sort of plan that helps you get there. And it’s not as if the plan was written somewhere but as we met every quarter, the board had the opportunity to check and improve which made, I think, you guys, came more prepared. It’s interesting, as this shows how important it is to learn from your mistakes and admit them. When you say “stop making phone calls and start meeting face to face”, it’s a statement, saying “guys, the way you tried selling until now doesn’t work. We all need to admit that and that is a major condition in order to move forward”. But we didn’t need to say that to them, I think they realized it by themselves. That’s why they had a payment page ready and that’s why, in April, when they saw the data of how many phone calls they made in order to get clients, it was the understanding of “ok, let’s start running Facebook ads and more, as this effort is not effective”. We can see that even the way they wanted to come back with KPI’s in April was the first time you wrote TROY in the board pack.

Eran: By the way, the fact that we talked to clients didn’t come from Roy & I. The last thing we wanted was to call clients and sell to them, but we just couldn’t do it any other way, so we tried to figure out what was the problem. After we understood we solved the problem and brought value to our clients using the “boards”, we gained that momentum. We could start doing online marketing and start building funnels and I think that you also mentioned it, Lior, learning from your mistakes is something etched in our brains, and we have it until this day.

I learned a lot from that period. The fact that we hit rock bottom taught me how important it is to get that validation and how important it is not to fall in love with your solutions, but to think around the problem and see where you can solve.

And I can say that since then, out of that trauma, we now implement it all the time, everywhere, which means we don’t fall in love with what we have but constantly try to re-think what is the problem we are trying to solve and how do we actually solve it. We did so many changes since then in the company, but I guess we needed that 9–10 month to bang with a hammer on our heads to learn that lesson. So I say it to all the entrepreneurs who are listening: As much as you are open to change, to have better conclusions, to look at the problem and not to fall in love with your own solution, that is the way to change faster. In hindsight I can say about that year that it was a complete waste of time, but we probably needed that time to learn our lesson. If you can learn that lesson before, I highly recommend it.

Avi: From my perspective, when you receive funding, you don’t get a license or permission to do whatever you want. Eran and Roy at the board meeting showed that they could look at the problem dispassionately and bring solutions. They didn’t have certainty that it would succeed but at least they thought through and executed a solution, showing a lot of maturity. The second thing is changing directions when necessary. Not to stick to what you think — to continuously ask questions and investigate and change. That’s a very important quality. I see entrepreneurs that succeeded in something before so they keep doing the same thing over and over again, not asking too many questions as they say “here’s a vector we can run with, if it ain’t broken don’t fix it”. But it’s not like that. I see it now with Eran. For example, one or two weeks ago I sent him the S-1 filing, the prospectus, for Zoom which was about to go public on Nasdaq (IPO), and there was some information there which I spotted thinking monday.com could benefit from… I sent him the prospectus, I didn’t say anything about what the information was or what he should do with it. A week later when we talked, Eran says to me “Listen, I’m going to revolutionize it all, I’m changing everything based on that S-1 filing…” I’m impressed over and over again with these entrepreneurs. monday.com is a company that is ten thousand times bigger than what it was a few years ago, yet when the founders understand that something is changing, they embrace it and take time to think about it. And I think it’s meaningful, always asking questions, always thinking creatively.

And this is how Monday will one day become a very successful company. We’re still at the beginning of the road and there’s a lot to build here, but I’m amazed every time I come to a meeting with these chaps.

Lior: Avi, if there are any entrepreneurs that are listening, any advice you’d like to give?

Avi: If you want an early stage investment, come see me! (laughter). I think that what is very important is your credibility with your company and investors. Things will change, and everything you write will change the day after, but the way you show it, and the way you work shows who will succeed and who will not.

Covering over, and hiding problems is not good for you, for the company or the investors. Coming with the right attitude, being honest, and consultative is the right way.

Investors want you to succeed and get good results and that is enough to bring them to help. So, find good investors, and be trustworthy and honest with your investors without playing games — this is what builds well run companies. You can’t guarantee success. But definitely you won’t have my support if you’re not 100% honest with me.

Eran: One notion that is important for me to clarify is that there are many entrepreneurs that start with many difficulties. And when they look at companies that are perceived as successful, they do reverse engineering and it seems like was easy for them. I’d like to clarify that we had many difficulties and breaking pints.

The fact that it’s hard does not mean that you won’t succeed, it’s important to understand why you are in the place you are at and try to get everyone out of it instead of digging deeper, head in the sand. It is very important at these points to find a way forward.

Good investors are important, as we had. We could have closed the company otherwise. “Winner” investors are very important, and I am grateful that we had that board meeting with Avi, and that secured his investment.

Lior : I will add something for myself: before an investment, you have the image of an investor on one side of the table and the company on the other. After the investment they are both on the same side of the table. Even in difficulties, they have to stay on the same side. Investors have generally more experience with startups and can have great ideas based on experience. My tip to all startups is to ensure you have healthy relationships. Thank you Avi for joining us.

Related Resources

How should I reach out to a VC for the first time?

Why is it so hard to get VCs to invest in my Generative AI Startup?