Venturing into a Cowless Future

Over the years I noticed subtle changes in the way people eat. Oat milk (and soy, almond, coconut, hemp, rice, cashew…) in coffee shops, non (and beyond) meat burgers, non-chicken wings, and vegan cheese pizza in restaurants.

It makes sense. Many are reducing or cutting meat and dairy intake altogether and are turning to alternative proteins instead. In fact, according to BCG estimates, by 2035, every tenth portion of meat, eggs, and dairy consumed around the globe will most likely be alternative.

Why are consumers shifting toward alternative proteins?

As a quick overview there are three primary reasons:

💰 1- The economics of it:

Cows, aka “real” meat/protein are only 3% efficient, and honestly, business-wise, since when is 3% an adequate efficiency for anything?. Also, livestock is the world’s largest user of land resources where 77% of agricultural land (51 million km2) is used to house and feed livestock, but, only 17% of global caloric consumption comes from animals… You do the math.

🌎 2- The climate impact:

The UN describes animal agriculture as “one of the most significant contributors to the most serious environmental problems, at every scale from local to global”. Cattle-rearing generates more global warming greenhouse gases (as measured in its CO2 equivalent) than transportation.

A quick reminder from middle school science: more greenhouse gases = global warming = danger.

🫀 3- The body and soul issue:

And of course, last but not least, the concern about animal products’ impact on our body (health-wise) and soul (consciousness). Health-wise, large farms can spread major bacterial infections like salmonella and campylobacter that can be transmitted to humans and make them ill.

And soul-wise – we won’t go deep into the animal cruelty issues – pretty sure we’re all clear about what we’re referring to. And if not, you can head to a local vegan protest or the PETA website to read more.

So what are the alternatives?

Currently, there are four primary alternative-protein options:

- 🌱 Plant-based protein: The soy, pea, chickpeas, etc. of the world

- 🐜 Insect-based protein: Edible insects with high protein content (either whole or extracted)

- 🧫 Fermented or mycoprotein: This includes fermented foods (like tofu and tempeh), biomass (pure culture of microbiological cells like fungi, yeast, and bacteria), and precision production (making a specific protein through microbial host organisms).

- 🧬 Animal cell culture: These are the “cultivated meats” and cell-based dairy products, where animal muscle and fat is produced using techniques similar to fermentation (but with animal cells instead of bacteria), which can be turned into structured meats and dairy (using a technique similar to tissue engineering in regenerative medicine…)

To us at Entrée, fermentation/mycoprotein and cultivation represent the future of alt-protein

As I started thinking about things like climate change and animal welfare over the past few years, we started meeting with the pioneers of this domain in Israel and overseas. I was also very early to try Impossible, Beyond, Oatly, etc., and did a lot of work researching the domain.

When I met Josh, the CEO and Co-Founder of Artemys (a cultivated meat company) in early 2020, I was blown away by his vision and his well thought detailed strategy on how to make the future a reality. He’s simply a brilliant mind that has done a share of exits in the past and now wants to literally change the world for the best. His co-founder Kasia is also Tier 1 and someone that I am very happy to “take a tech risk on”.

Not too long after that, we met with Eyal, the CEO and Co-Founder of Imagindairy (producing commercially viable milk proteins through precision fermentation of fungi). In our eyes, Eyal’s strategy about being the best at producing the proteins is the way to go, and his experience both as a scientist and as a business executive impressed me a lot. To top it off he built a WORLD CLASS team of scientists around him (Tamir Tuller, Arie Abo) which made it clear: if anyone will get it right on earth, it’s this team for sure.

I started investing in this space because I believe that:

- In 50 years there is NO CHANCE that “regular” meat and dairy will have over 10% market share in the western world.

- The end game is that the other 90% will be mostly cultivated and not plant-based as people want the same flavor and nutritional value. TBH, if we were really happy with plants we would have stopped eating animals 500 years ago, or today…

- Tech is now enabling this future: the cost reduction of fermentation, SynBio (like new tools such as CRISPR), and more. This is the perfect storm for us as a VC to not be a bystander but help power the future.

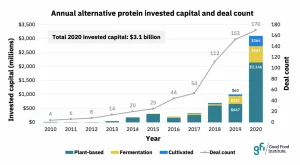

And we’re not the only believers here. In total, according to GFI, $3.1 billion was invested in alternative proteins in 2020, highlighting growing momentum for alternative and sustainable food choices.

Some tips for alt-protein startups

- The test of taste, price, and trust is a make-it-or-break-it: To meet (or possibly exceed) the current meat and dairy consumption levels, alternative protein companies have to ensure that their products taste good, are not too pricey, and that consumers trust and know their products.

- Make a stand-out product or solution: The space is now pretty crowded, so it might be hard to make another top-selling oat milk – BUT there is huge potential in the fermentation and cultivation space. Go to where the science is.

- Know your audience: Right now, people are more willing to replace their “day-to-day” burger, yogurt, kabab, sausage, etc rather than order a full fillet (this will definitely change, the question is when). Keep this in mind when you’re building your tech or offering.

- Choose your partners well: At times, many companies fail to understand the challenge in working with some of the industry giants; their plan on integration into the heavily controlled industry might be somewhat naive. If a startup decides to go B2B here, they MUST really know their food company partner and understand what the next 5 years of partnership with them will look like.

The Future of Food Investments

We highly recommend that our colleagues in the VC community take a closer look at this space. It all fits seamlessly with Entrée’s general investment strategy:

There is a huge TAM that’s shifting due to consumer demand (timing); advancements in tech are enabling things that were never before possible (also timing), and there are FANTASTIC teams out there building their vision of the future in an industry that can satisfy venture returns.

One thing is for sure, we at Entrée are looking forward to our first cultivated burger, a cow-free yogurt, and to continue investing in the future of food. So just a heads up: spend time in this area because it’s going to be massive with some very big winners.

Related Resources

A Letter to Startup CEOs

The Rise of Construction Technology