Why should your pitch start with “Timing”?

In Israel we see about 800 startups per year, most of which we cannot meet face to face. As we cannot spend hours and days doing research on each, how do we filter and focus our attention on the few?

VC’s judge startups typically by considering some of the following: Team, Market, Problem, Solution, Innovation, Product, Traction, Execution, Scalability, Business model, Go-To-Market, Competition, and Financing.

One quality which we do not feel has received enough attention is one of the most important if not the most important one of them all — Timing.

This is a key quality for us when we filter and decide where to place our attention.

What is Timing?

Timing is the complicated answer to the simple question: Why should your venture be launched today? Some examples follow.

Technological change

The internet, personal computers, GPS, and broadband are all technological advancements which enabled the existence of the some of today’s most valued startups (Google, Apple, Microsoft).

When there is a meaningful new technology introduced there is opportunity.

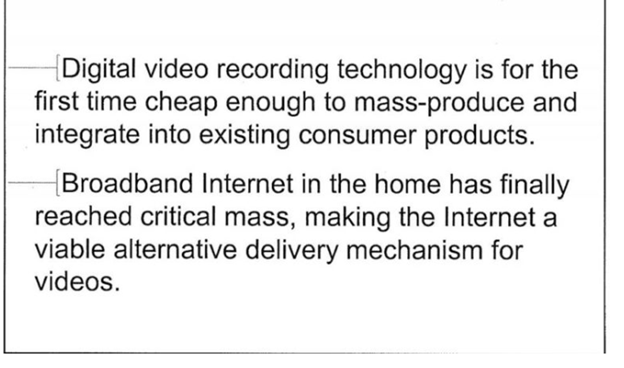

YouTube for example launched at the same time as broadband improved and digital cameras and smartphones became ubiquitous. Had YouTube launched three years earlier, it probably would have failed. Three years later and the competitors would have eaten their lunch! (Their pitch deck from 2005 is actually available here).

Regulatory change

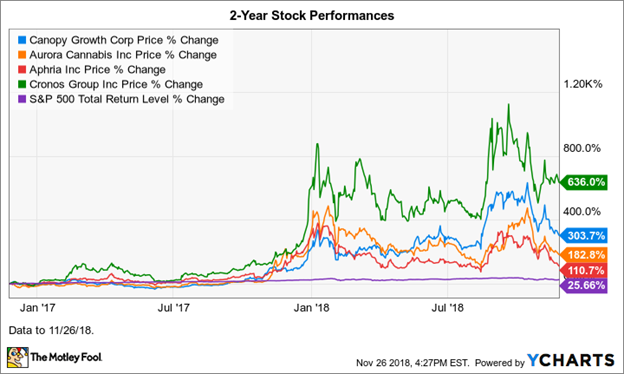

Cannabis was legalized for recreational use in Canada in October 2018. Many US states have done the same (Colorado, California, Nevada and others). There seems to be a new wave of acceptance of cannabis even throughout Europe (although mostly only for medical purposes at this moment).

Not a surprise, as evident from the graph above, the value of the licensed producers of cannabis has rocketed.

FlowHub which launched in 2015 and already raised just under $30mm is one of the startups which are perfectly positioned to capitalize on the market opportunity.

Cultural change

This is a very difficult one to grasp as it does not happen all at once i.e. a law being passed that changes the environment.

Over time it is as if people decided that it’s ok to sleep at strangers houses (AirBnB) or ride in a car with strangers (Uber). These consumers also decided they want everything NOW and they don’t really need to own stuff if they can pay as they consume a service. All of this came together resulting in Airbnb and Uber.

These cultural changes are huge enablers, which are subject to change as the consumers evolve or collectively change their minds a few years down the line…

Economic factors (Interest rates, Recession)

Many argue that the rise of startups such as WeWork and Uber are also a result of low interest rates, which creates an influx of capital into the Venture Capital market, which in turn creates the ability for companies to grow to enormous size while being unprofitable. This might be right.

After the recession, the “Sharing Economy” boom made sense as people wanted to conserve cash, or were spendthrifts.

Case Study: IRP

We invested in a company which develops a software defined electric power train for EV’s.

Why Now?

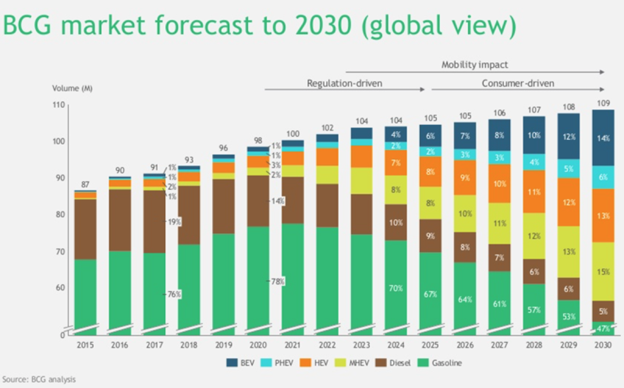

- Regulation — China among many other countries, has legislation which forces companies to reduce their carbon emission — electric motor vehicles enable this.

- Technological advancement — over the past 3 years, battery and electric power management technologies have doubled the range of EV’s and reduced the overall purchase price. These advances are still not enough to enable mass adoption but it is a step in the right direction.

- Cultural changes — humanity is more aware of climate change (Greta Thunberg rising in 2018) and as a result people care more about recycling, plastic, clean energy and sustainability. This has moved from an early adopter to the early majority market (Ocean Cleanup, Impossible Foods, SolarCity, BreezoMeter and many others raising the “Clean” flag with pride).

- Economic changes — The Price of EV’s has dropped to a point that the TCO (Total cost of ownership which includes gas, maintenance etc.) will reach parity with ICE (Regular) powered vehicles in the next 1–3 years and even the purchase price parity might happen in the next 3–6 years.

The above changes are all pointing at a clear direction, the EV market is (finally) happening and therefore 2019 is the right year to launch this venture.

Important side note: the right timing must lead to a big market opportunity — if the total market of EV’s would be $50 million it would not be interesting for VC’s right?, make sure the right timing is leading to a multi billion dollar opportunity.

How can you tell if you are starting your company at the right time?

Two guiding questions to consider:

- Why hasn’t anyone tried this before?

In many cases the answer (which is obtainable by Google) is that many have tried and failed, or already succeeded.

In some cases, we see startups go after the same problem which seems to simply never get solved. The reasons are sometimes around anuneven market share split in a certain market, which keeps new entrants small, or even a regulator which enables a monopoly for his own obscure reasons.

- Why is today the time to start this company versus 4 years ago? Or versus 4 years into the future?

More often than not, if there is no good answer it probably means there is no clear market opportunity right now.

The reason is that if it were possible to launch 4 years ago, someone would have (competition) and if the right time is too far into the future, due to technology not being there yet or consumers are indifferent (EV’s 10 years ago) then the venture probably won’t succeed.

No linear changes!

Often, when asked about timing, founders will explain a change which sounds like “the big banks understand the UX must improve” or “it can’t be that in 2019 they still use paper in department X”.

They are right, but when the opportunity is a slow haul over years and it’s the only driver you have, it might not be enough to really breakout. The most valuable changes are either on a few fronts, or very sudden in the sense that on Monday this was not possible and on Tuesday it is (Cannabis being legalized for example).

Bottom line

For those of you looking for quantitative data to prove the above, listen to Bill Gross, founder of PIMCO (spoiler: 42% of what makes a startup succeed is timing).

As a Founder if you are convinced that timing is important, pitch it properly. Spend time to illustrate why timing is important in the materials sent to a prospective VC.

We find that many Founders do not think deeply about Timing, as it’s out of their control. It’s a factor which needs to be taken into consideration prior to launching the venture and cannot be added easily along the way but for us, at Entrée Capital — TIMING is a key to success.