Launching $300 Million in New Funds to Back AI, Deep-Tech, Crypto and Generational Founders

We are excited to announce that Entrée Capital is launching our new funds, in the amount of $300m, targeting early stage investments. This milestone brings the firm’s total assets under management to $1.5 billion, underscoring our unwavering commitment to “backing exceptional founders building the impossible” in a rapidly evolving global tech landscape.

The new capital will be primarily deployed across pre-seed, seed and Series A investments in Israel, United Kingdom, Europe, and the United States

The new funds will target founders building in:

- Artificial Intelligence — AI-native applications, vertical AI, and enabling infrastructure

- Deep-Tech & Quantum Computing — compute, science-driven systems, advanced materials, and dual-use technologies (DefenseTech)

- Software, Data & B2B Productivity

- Crypto, primarily Infrastructure and Security

- Contrarian “Weird Is Wonderful” frontier innovation

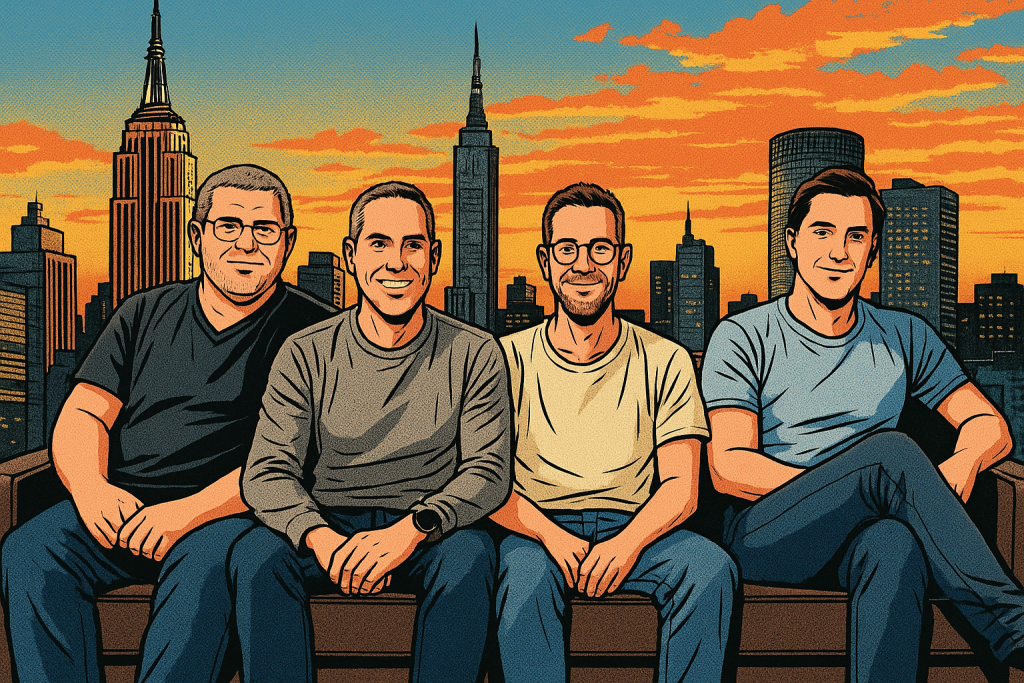

“Our mission is to partner with the exceptional to build the impossible. As AI and Web3 evolve and disrupt it all, our mission is ever more relevant and we are looking to meet these outliers.” Avi Eyal

“We are entering a new era where physics, compute, software, and national-security innovation converge. Israel remains a global powerhouse for deep-tech and quantum innovation, and we are scaling that reach across Europe, the UK, and the United States.” Ran Achituv

“AI is not a fad. It is a foundational transformation of the global economy. We are focused on AI-native founders building vertical agents, infrastructure, and category-defining software. We’ve been investing in AI for over 7 years, and these funds will double down on the theme.” Eran Bielski

“Entrée stands out because of its deep founder DNA and its commitment to standing with entrepreneurs from day zero. I am excited to support world-class founders building enduring companies from Israel and globally.” Yoni Osherov

“The biggest opportunities are in the verticals everyone skips because the software spend looks tiny – these industries typically run on paper, phone calls, and decades-old servers. AI doesn’t care about historical software budgets, and neither do I. One sharp wedge—hardware, ambient capture, autonomous agents—unlocks the entire P&L. The less software these categories have bought in the past, the more violent and complete the reset will be.” Saul Levin

“Three themes are top of mind : AI agents, decentralized physical infrastructure, and policy automation. Web3 is evolving from speculation to institutional adoption, where real utility and infrastructure take center stage. AI agents capable of autonomously holding, allocating, and trading capital within cryptographic policy frameworks are emerging, and, in parallel, decentralized physical infrastructure is expanding which will be secured and priced on-chain. Policy automation and compliance as code are enabling institutions to interact with these systems safely, embedding trust and regulation directly into programmable finance.” Tomer Niv

Related Resources

Guidde: The AI-native horizontal PLG startup that could

The SaaS Reckoning: Surviving the AI Token Revolution